For over a decade I lived in New York City and had the opportunity to eat and drink very well. It’s hard not to in that town. Throughout the years I had clients who invited me to great restaurants where we had amazing food and drank awesome wine. Many other times it’s been dinner with fellow market participants or family and friends. While I was easily able to appreciate the high-quality plates put in front of me, the wine that went with it was usually more of a mystery for me.

They would ask me, “JC do you like the wine?” And while I almost always did, I could never explain why. Yes, I liked it. Or no I didn’t like it. That was the extent of my wine knowledge. Sure I’ve traveled to Bordeaux and Tuscany over the years but I still couldn’t tell you why I liked or disliked a wine.

In 2015 I had the opportunity to move to California to focus on building some pretty awesome things. I’ve already rolled out a few of these including my Chartbook with over 500 regularly updated charts and the new Advisors Corner which is specifically designed to help Financial Advisors help their clients. This year I also hosted Chart Summit, the first ever 100% virtual Technical Analysis Conference. Wait until you guys see what I’ll be rolling out later this year!

For the past 2 years I’ve been living in Sonoma Valley California, what I consider to be the best county for wine in North America. After the move from New York I decided to educate myself and so I read a few books on the art of wine making. Weekends in Sonoma consist of beautiful days and delicious wine. It’s been an incredible learning experience, to say the least.

After a few conversations with wine experts, I was convinced that I could take the first level of the Sommelier exam without really having to study for it. I’m busy trying to build something special here at All Star Charts so the last thing I need to be doing is studying for another test. Remember it already took me years throughout 2006-2008 to earn my Chartered Market Technician (CMT) designation. I’m not trying to study for something else.

As someone who spends many hours in front of a screen looking at charts for days, learning other things to take my mind off the market can be incredibly therapeutic. I’ve become a much better skier, I’ve learned to cook on facetime with my grandmother as she teaches me her old Cuban recipes and more recently I’ve taken wine much more seriously. It’s been a lot of fun trying different varieties and styles from around the world now that I understand it so much better.

Anyway, I looked it up online and signed myself up for Introductory exam through the Court of Master Sommeliers. This is more of a service designation, but although I have little interest in ever working at a restaurant, I would like to make some wine one day so why not educate myself a little first?

The Intro Exam for the Court of Master Sommeliers consists of 2 days of intense lessons by 4 Master Sommeliers where they teach you about wine all over the world, various methods, styles, laws and traditions. There are 6 different tastings and over 25 different wines that you get to try. I figured it would be a cool experience and if I’m lucky I may even be able to get through level 1 without having to prepare beforehand.

The closest location and date that worked for me was in Reno, NV in early June. So I said why not? Let me do something selfish for myself and go for it. So I jumped in the car and made the 3.5 hour drive to Reno from Sonoma. I had never been to Reno before.

As it turned out I was probably the only one there who did not prepare before coming. There were about 80 people from all over the west coast and most of them were in the wine business. I was one of the few outsiders. That was fine though.

Truthfully, I didn’t really know what I was getting myself into. I figured I would learn about wine, taste some good vino and meet cool people. As it turned out, that’s exactly what it was! But in hindsight, I do wish that I had studied for the exam prior to the trip. I think would have gotten a lot more out of the experience. That was my bad for sure. The good news is that I did pass! It was about a 60-70% pass rate. I thought it was hard but the people who prepared for it did not. Every seemed to think it was easy. For me I think the combination of living in California for 2 years and also knowing the roots of many of the words in the Romance languages had to help. I speak Spanish fluently and have studied some Italian and French. That totally helped me pass because it seems like 80% of questions came from countries that speak those languages.

The reason I wanted to share this experience with you guys is that as I sat there for 2 days learning about making and tasting wine, it was immediately clear to me what was going on. The Master Sommeliers use something called the Deductive Method. By looking at the wine, smelling it and then tasting it, you’re working your way from the top/down trying to identify what the variety of the wine might be. Technical Analysts do the exact same things to try and identify the direction of a market trend and decide whether or not to buy or sell a stock! I couldn’t believe it. I’m like, “Damn I can do this! I’m already doing it every day. It’s just different data. Sommeliers are Technical Analysts!”

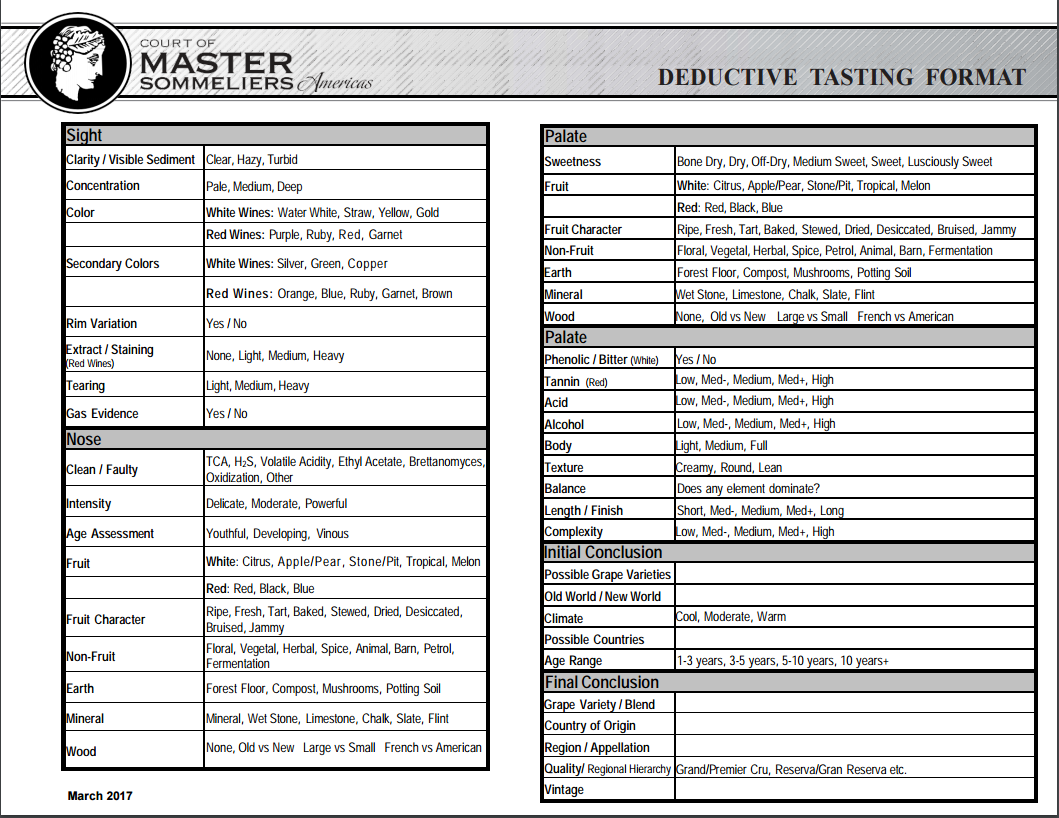

This is what the Deductive Tasting Format looks like. It’s a 5-step process where you first look at the wine. For example, if the wine is red, you can already eliminate grapes like Chardonnay, Pinot Grigio and all other white wines and Rosé. If there are a lot of tears on the sides of the glass you can start to eliminate wines with lower sugar and/or alcohol levels. The point is that you’ve already eliminated the majority of possibilities and you still haven’t even smelled or tasted the wine:

Click to zoom in

As Technicians, the first thing we do is pull up a chart whenever the trend of a security is in question. Just like it is obvious that a wine is most likely not a Cabernet Sauvignon if it has a bright white color, a stock making new multi-year lows is most likely not in an uptrend. In the case of a white wine that is very water white or straw colored, we can probably narrow it down to a higher acid wine and not a fuller-bodied wine aged in oak and can then be confirmed once we smell it. For both Sommeliers and Technicians, these are very obvious observations that don’t take much effort, but they eliminate the majority of possibilities just at first glance.

Once we’ve identified the direction of the underlying trend, we want to look at some of the supporting indicators like momentum, smoothing mechanisms and relative strength. Although price-based, they are just derivatives of that price behavior. In wine, the smell, the color, the taste and the second taste are all reflections of the type of grape, where it came from and decisions that the winemaker made throughout the wine making process. When we look at the behavior of price, normally in chart form, the movements are representative of a variety of factors. These include what the rest of the market is doing, the sector in which the stock belongs, intermarket relationships with other asset classes like Crude Oil and Energy stocks, relative strength, momentum and an infinite amount of other factors that impact fear and greed. The chart is the end results of an unlimited list of factors. The wine is the result of many differences amongst grapes and regions as well as decisions made by the wine maker. It’s no different.

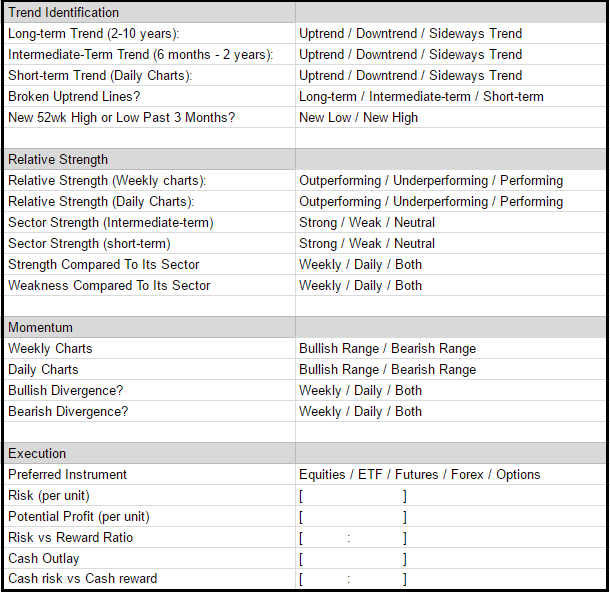

We can probably create a similar table like the one above but to analyze stocks. It would start something like this, although I think we could all agree that it can be customized according to your specific tools, time horizon and overall goals. Mine would likely start like this but I think still needs more global macro context somehow. I’ll be giving this some thought throughout the rest of the summer and hopefully come up with something that represents my process a little better. Stay tuned for the All Star Charts Deductive Trading Format™ Coming soon!

When looking at the market overall, we want to use a variety of indicators and measures to make a decision that is based on the weight-of-the-evidence. Just like we gather all of the data, organize it in chart form and then come up with a conclusion, Master Sommeliers do the same thing. You can see in the table above how they go step-by-step analyzing all of the data piece by piece. They are building a puzzle just like we are as market participants. It was an amazing surprise!

The Deductive method being used is just classic reasoning where a conclusion is reached reductively. By applying a variety of guidelines you can narrow the range under consideration until on the conclusion or just a few conclusions are left. By looking for strength in stocks around the world, we can already eliminate countries that are making new lows as the rest of the world makes new highs. If the S&P500 is making new highs, we don’t want to be buying the sectors breaking down. We want to own the leading stocks inside the leading sectors. We use a use this Deductive Method in order to find a conclusion, or investment in this case. Sommeliers use all the information to narrow down the possibilities to a Cabernet Sauvignon or Nebbiolo, for example. Two similar styles made in different parts of the world. As Technicians we want to narrow it down to buying a bank stock or owning the entire sector’s ETF, for example. The top/down approaches are incredibly similar.

Who knew? Sommeliers are actually Technical Analysts!

Should I study for the next exam to become a Certified Sommelier? I’m already doing the same thing in the market every day! So why not?